Information on this site was last updated. Listing(s) information is provided for consumers personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Neither listing broker(s) or information provider(s) shall be responsible for any typographical errors, misinformation, misprints and shall be held totally harmless. All properties are subject to prior sale, change or withdrawal.

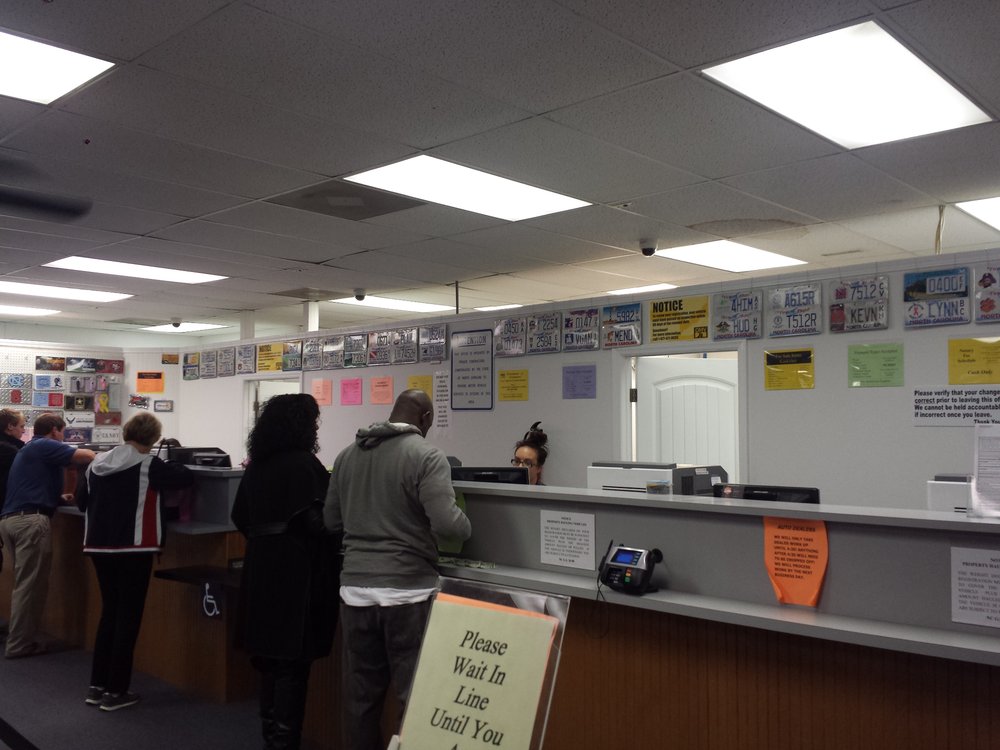

#NC TAG OFFICE REGISTRATION#

Select the year desired and all vehicles paid for that year will pop up with the total taxes paid for each vehicle in that calendar year.īusinesses will not be able to access tax information through the MyDMV Portal and will need to refer to the information on the Registration Cards or contact our office at (828) 265-8024.All information deemed reliable but not guaranteed. Under “Correspondence” the Taxpayer will be able to select the year for Vehicle Property Tax Fee paid or as pictured VEH PROP TAX FEE. Once logged in, the Taxpayer will see “Correspondence” on the right middle third of the window.

#NC TAG OFFICE PLUS#

I-94 (Arrival/ Departure Us Customs Form) or Alien Registration Number, plus their birthdate. Along with the Last 4 Digits of their Social Security Number.

#NC TAG OFFICE LICENSE#

Taxpayers will need their NC Driver’s License or NC Identification Card Number. If you have misplaced your Registration Card with the paid vehicle tax information on the right side, below is the link to access the MyDMV Portal for your paid vehicle taxes. Just as in the past, vehicle owners will receive the notice about 60 days prior to their vehicle’s registration expiration. Division of Motor Vehicles, you will receive a Tag & Tax Notice listing both vehicle registration fees and taxes due. North Carolina’s new Tag & Tax System has been designed as a convenient way to pay annual vehicle tag renewals and vehicle property taxes. In doing so, the new law transfers the responsibility for motor vehicle tax collection from the 100 counties across North Carolina to the Division of Motor Vehicles (DMV). The North Carolina General Assembly passed a new law to create a combined motor vehicle registration renewal and property tax collection system (Tag & Tax System). Now, your annual vehicle inspection, registration renewal and property tax are all due the same month each year. One Payment - made either in person, online, or by mail.Ĭompletes the annual tag and tax payments for your vehicle.

The Tag & Tax System makes it easier to manage your vehicle registration and taxes. Pay it all together with one simple online payment at MyDMV, by mail, or in person. You'll receive one bill in the mail about 60 days before your vehicle registration expires. Starting in mid-2013, your vehicle registration renewal fees and vehicle property tax will be due at the same time.

Watauga County has contracted with NCDMV to operate the License Plate Agency for the purpose of providing citizens with a convenient and efficient service for the renewal of license plates/registrations and issuance and transfers of titles.Ģ74 Winkler’s Creek Road Boone, NC 28607

0 kommentar(er)

0 kommentar(er)